Unlock the editor’s summary for free

Roula Khalaf, editor of the FT, selects her favorite stories in this weekly newsletter.

The US actions recovered on Friday, eliminating the strong losses that followed the announcement of the “Liberation Day” rate of Donald Trump a month ago, after the labor market data exceeded expectations.

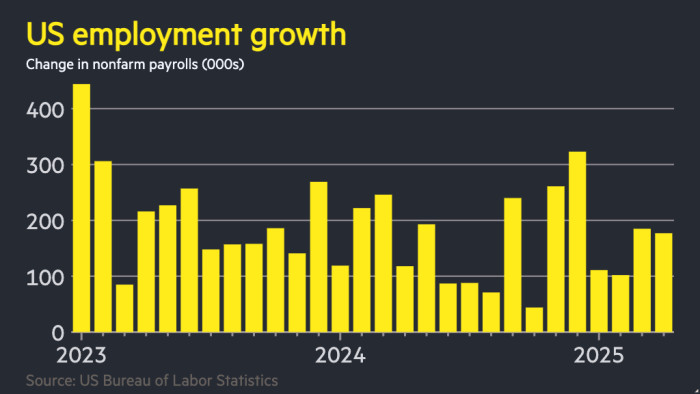

The 177,000 jobs added in April, according to the Office of Labor Statistics, exceeded 135000 predicted by the economists surveyed by Bloomberg, although the number marked a March fall.

The S&P 500 rose to 1.6 percent on Friday, which took it above the closing level since April 2, when Trump announced his “reciprocal tariffs.”

The Wall Street shared resources index had looted up to 15 percent in several days of turbulent trade after the announcement of the president of the United States, which caused tumult in world financial markets.

But global actions have been recovered to a large extent, helped by the signs of a possible thaw in commercial tensions, including comments from the Ministry of Commerce of China on Friday that Washton recently had “a desire to participate” in commerce.

“This demonstration seems to be in the expectation that, regarding tariffs, the sausage has passed,” said Ajay Rajadhyaksha, president of Global Research in Barclays. But he added: “In fact, it is exactly the opposite. The sausage has not yet appeared in the data. Nothing has appeared in the data.”

Despite the recovery in the stock markets, the dollar remains 4 percent below its “release day” level.

After Friday’s job data, the performance of two -year treasure bonds, which tracks interest rates expectations and moves inversely to prices, increased 0.13 percentage points to 3.83 percent as investors bet that the United States financier for cost cost costs costs.

“People feared a missing surprise that was not near,” said Mike Riddell, a Fidelity International fund manager.

Merchants continue to forecast at least three interest rate cuts this year, but the hood of a quarter half was reduced to approximately 30 percent from about 60 percent before the works are encased.

Goldman Sachs said he had backed his expectations from the next rate reduction per month from June to July.

“Fed should reduce its rate!” Trump posted on his social network of truth shortly after the job data came out, while praised “strong employment and many more good news.”

The number of jobs on Friday occurred after massive shots of thousands of federal employees for the so -called Elyd Musk government efficiency department. The data indicated that the use of the federal government decreased by 9,000 in April and 26,000 since January.

In addition to the main figure of April or 177,000 new jobs, the total number for March was reviewed from 228,000 to 185,000.

The inempleal rate did not change from March to 4.2 percent.

Claudia Sahm, Chief economist of New Century Advisors, said that although Trump’s economic policies were “anything but subtle”, their initial impact was “relatively small.”

He added that it would take time for policies to “work through the system, that Meeaans will wait”, and that any cuts were probably later in the second half of the year instead of the duration in the next two months.

This week’s official data indicated the first fall in GDP for three years, but they were distorted by an increase in imports before Trump’s tariff announcement, with a domestic demand that is soaked strong.

Many economists anticipate that tasks will act as a drag for underlying growth in the second quarter of the year.

“In general, this is an indication that the labor market is not deteriorating yet,” said Gennadiy Goldberg, head of the American tariff strategy on TD Securities, about Friday’s work data. “But investors are still nervous that another shoe falls. We just don’t know when.”

Ian Smith additional reports in London

]